Navigating the New Era of Bitcoin Legality: Understanding El Salvador's Groundbreaking Move

Navigating the New Era of Bitcoin Legality: Understanding El Salvador’s Groundbreaking Move

Quick Links

- Background on Bitcoin in El Salvador

- Data Shows Adoption Is Low and Stalled

- Chivo App

- Lack of Trust & Privacy Are Deterrents

- Failure to Capture Remittance Market

- Silver Linings

- Lessons Learned

Bitcoin has been legal tender in El Salvador since September 2021. It’s a bold financial experiment—so how’s that going? Data based on a survey by the National Bureau of Economic Research can help us understand how the process of Bitcoin adoption is going for everyday people.

The results show that after the initial big push from the government of El Salvador to encourage its citizens to begin using this new financial system, enthusiasm and adoption are lackluster. Adoption in most key metrics has atrophied, and there’s little momentum.

Background on Bitcoin in El Salvador

El Salvador’s currency since 2001 has been the US dollar, which makes them completely dependent on the United States to formulate their monetary policy. In September 2021, El Salvador became the first country in the world to make Bitcoin legal tender by passing the Bitcoin Law which required all economic agents to accept Bitcoin for all payments.

To facilitate this new system, the Salvadoran government also launched an app called the “Chivo Wallet,” which allows users to digitally trade both Bitcoin and dollars over the Lightning Network , a layer 2 solution for quick and cheap peer-to-peer payments using the Bitcoin blockchain network as the foundation. To backstop this new system, the El Salvadoran government has been buying Bitcoin on the market and holding it in reserve to create a liquidity pool for exchanging US dollars to Bitcoin and vice versa.

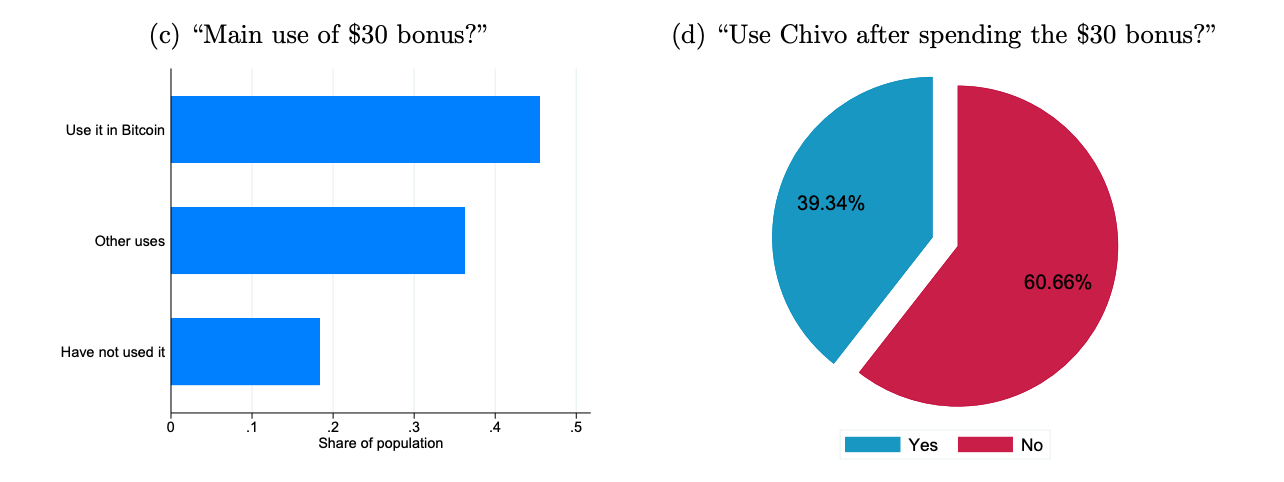

The government created a $30 incentive available to anyone who downloads the app and enrolls. Keep in mind that $30 is a decent amount of money for many citizens, and is equal to approximately 0.7% of per capita annual income in El Salvador .

Data Shows Adoption Is Low and Stalled

National Bureau of Economic Research

The data on El Salvador’s Bitcoin strategy is significant because it allows us to see what happens when a country decides to deploy cryptocurrency at a national level. Remember that this has never been done before, so it’s essentially an experiment that many stakeholders, industry leaders, investors as well as other nations are observing intently around the globe.

National Bureau of Economic Research

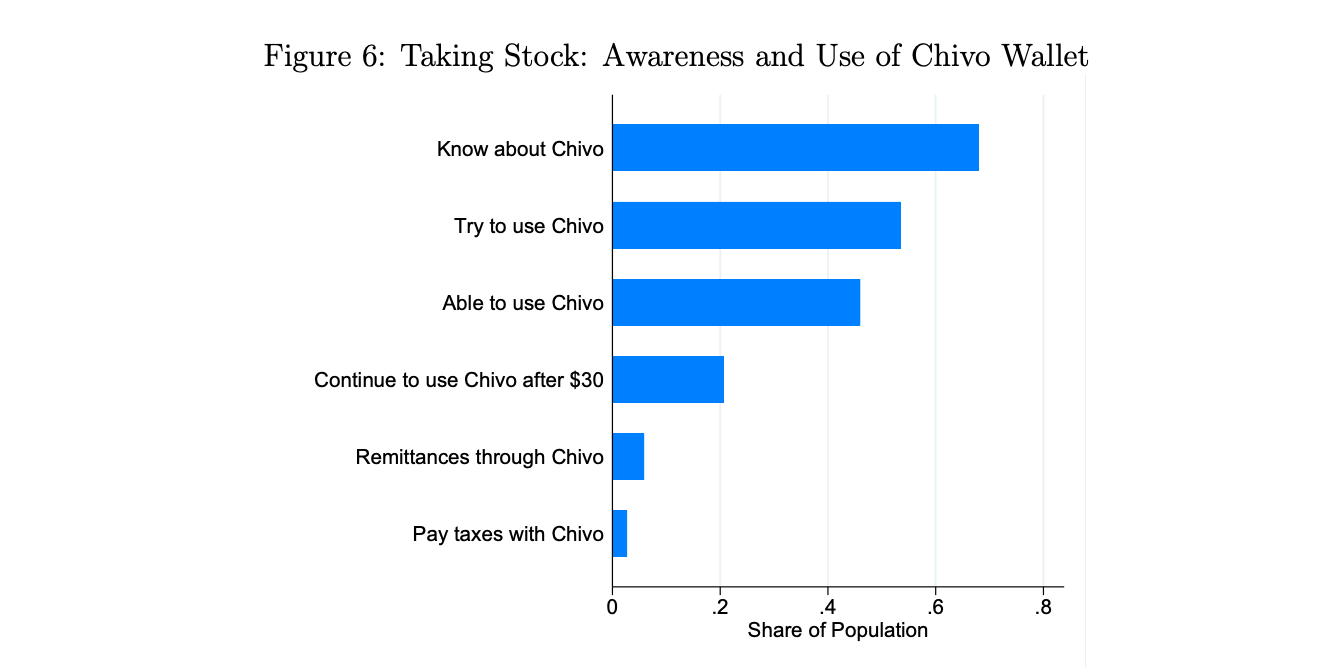

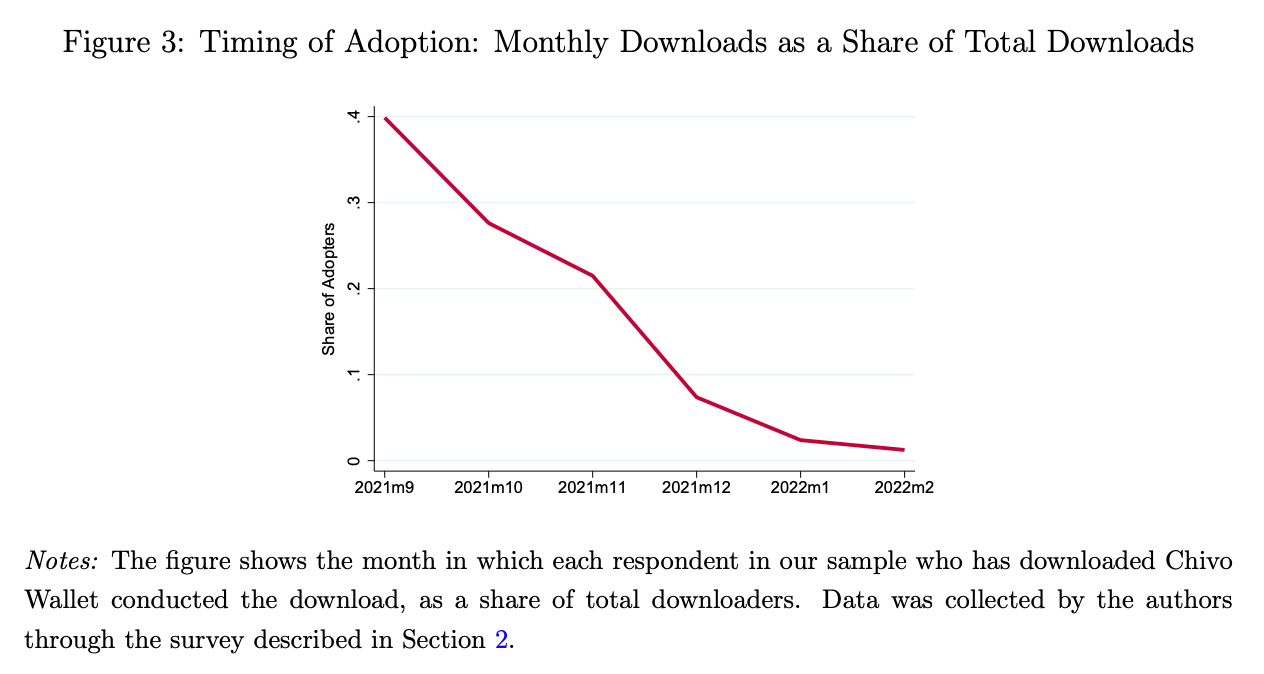

Bitcoin’s use as legal tender and its associated rollout in El Salvador isn’t going as well as they hoped it would go. Although many El Salvadorans have a smartphone with internet access, less than 60% of them downloaded the Chivo Wallet required to participate. Less than 40% of citizens who downloaded the app continued to use it after claiming their $30 bonus incentive.

National Bureau of Economic Research

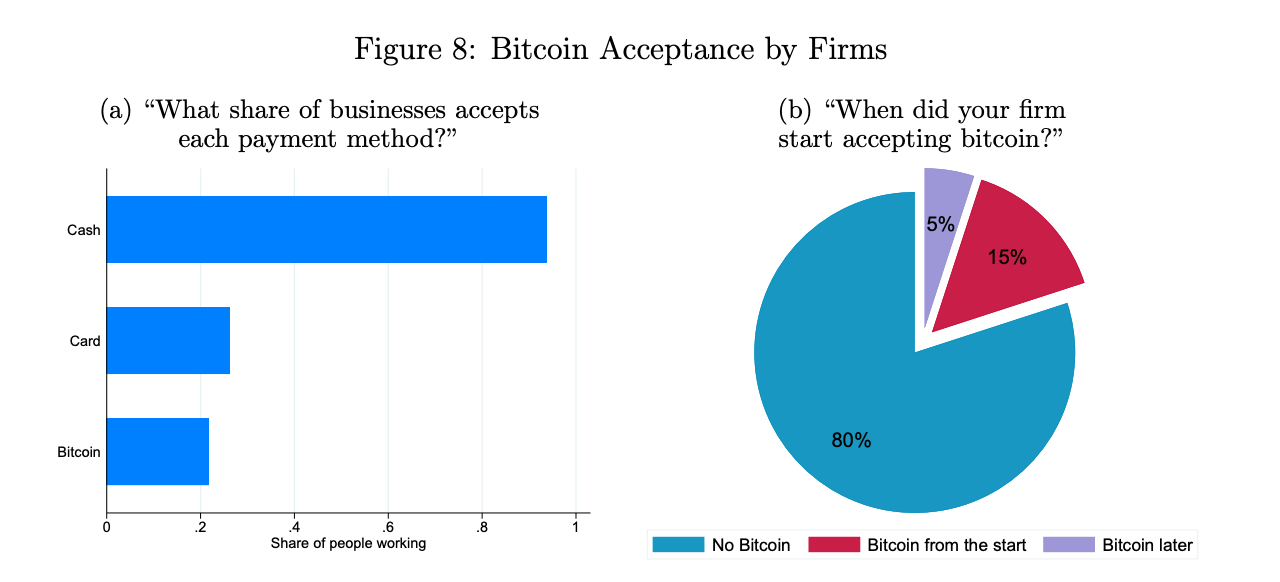

All businesses were required to begin accepting payments in Bitcoin but that has not happened. Only 20% of companies reported accepting Bitcoin as a form of payment and most of them were large organizations. Out of all sales, only 5% were conducted in Bitcoin and most transactions were converted to dollars within the Chivo Wallet upon receipt of payment.

Chivo App

National Bureau of Economic Research

The Chivo Wallet application was created by the El Salvadoran government to facilitate the adoption of their new monetary policies. The Chivo Wallet has been plagued with issues and has therefore had a mixture of effects on the roll-out.

When it first launched, there were problems with registration and the identity verification process. Because of the $30 government incentive, there were many instances of fraud, identity theft, and phishing attacks with people attempting to claim the $30 incentive for others.

The survey reveals that 68% of people know about the existence of the app and of those 78% of those who had heard of it downloaded or attempted to download it with the help of family or friends. The most common way they learned about the app was through social media, then by television and radio, followed by the news, and lastly friends and family. Only 40% continued to use the app after claiming their $30 incentive.

Over 21% of respondents knew about Chivo Wallet but did not attempt to download it. The most important reason reported was that users prefer to use cash. This was followed by trust issues—respondents did not trust the system or Bitcoin itself. The fourth most frequent reason mentioned was not owning a phone with the internet, followed by the technology being complicated.

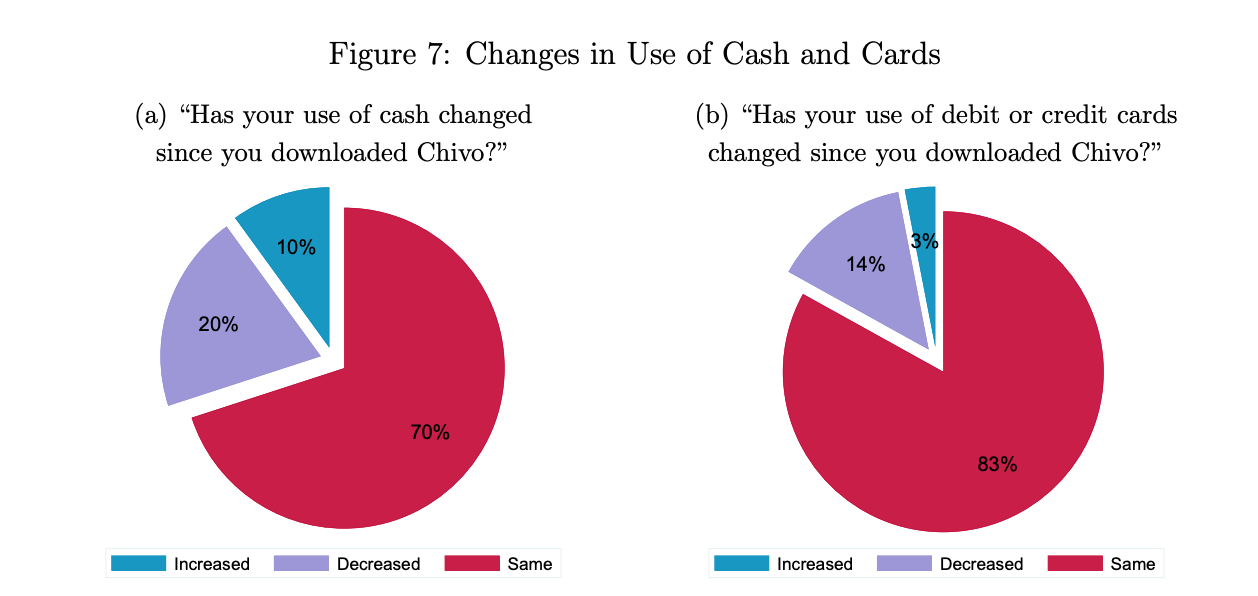

When El Salvadorans do use the Chivo Wallet, they tend to transact in US dollars because the volatility of Bitcoin is seen as a liability to them. A fluctuation of several dollars might mean they cannot afford to eat the next day or afford transportation to work.

Anecdotal evidence suggests that the app is used by a subset of the population like street vendors as a cash replacement because it’s convenient for small peer-to-peer payments. This functionality is actually what is most used within the Chivo Wallet because you can use the app like Venmo and quickly send US dollars from person to person without any exposure to Bitcoin.

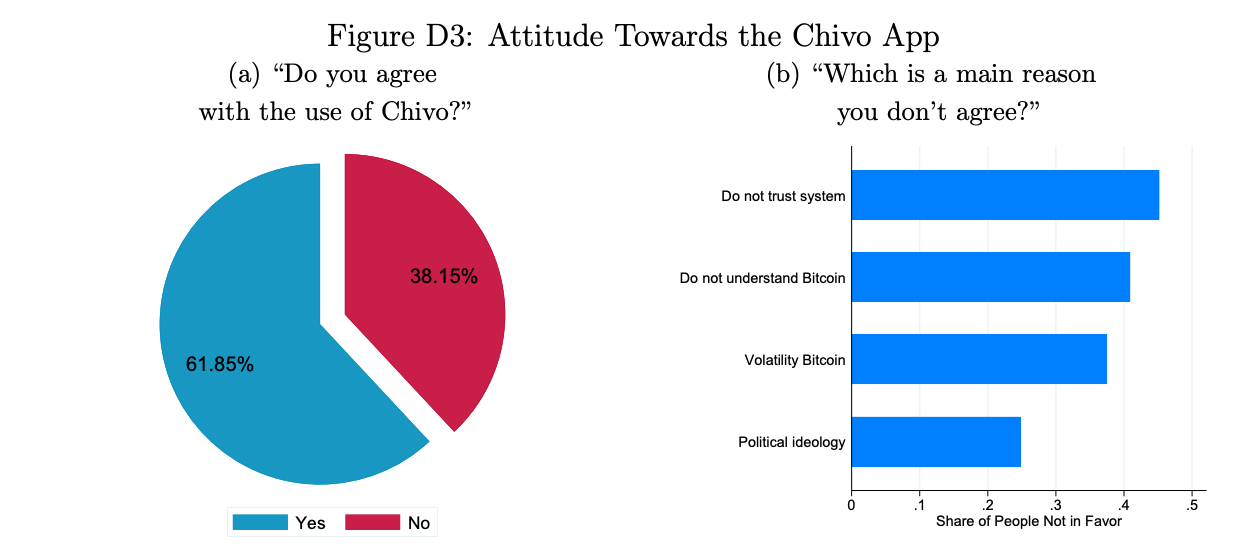

Lack of Trust & Privacy Are Deterrents

National Bureau of Economic Research

Going from the mindset of a cash economy where all transactions are essentially anonymous to an environment in which every financial transaction is now under the guise of the federal government is a big switch that many citizens were not ready to make.

When you download the Chivo Wallet, you have to complete an identity verification process commonly referred to in the industry as Know Your Customer or KYC. This is a common practice when onboarding into many cryptocurrency exchanges. Because of this process, the government can track and trace every transaction that happens using the Chivo Wallet. Opportunities for surveillance are another critique that people reported in the survey when deciding not to participate citing they didn’t trust the system or the technology.

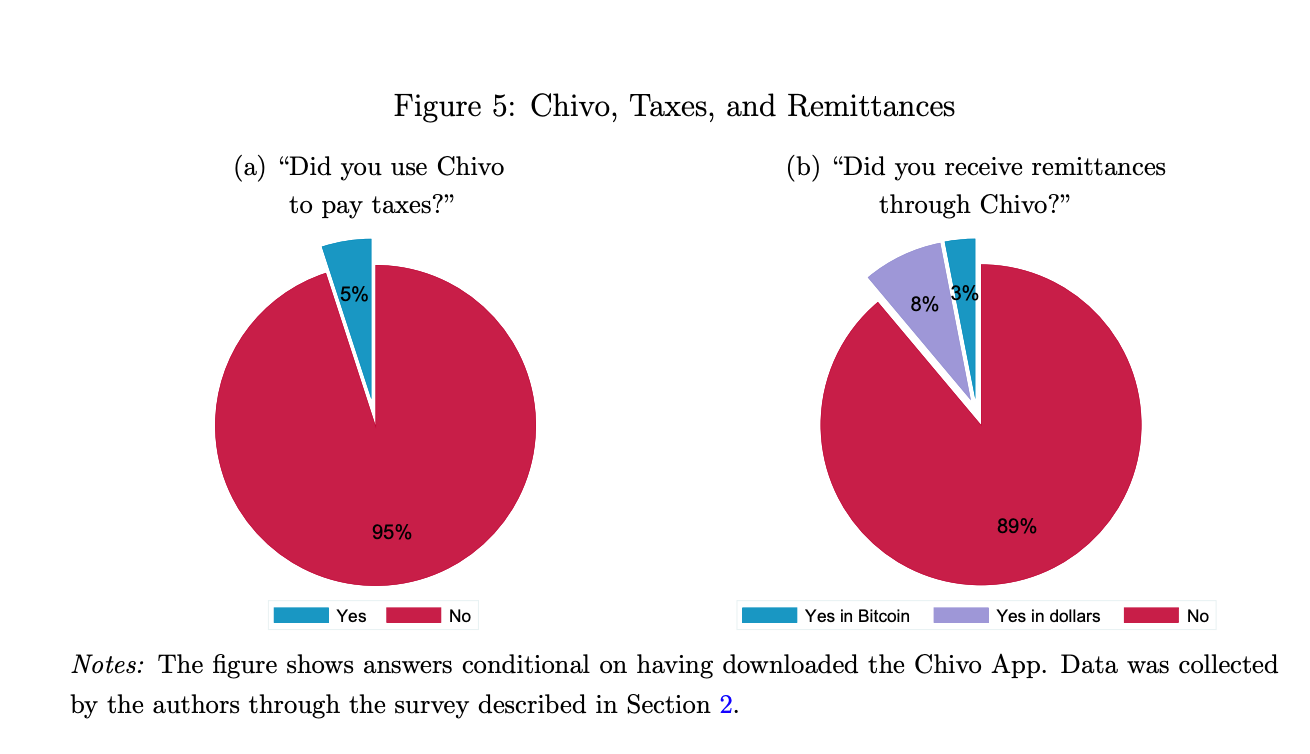

Failure to Capture Remittance Market

National Bureau of Economic Research

A major use case lauded by supporters is the amount of money that would stay in the hands of El Salvadorans rather than money gram companies. Remittances account for 20% of El Salvador’s GDP.

However, the study shows that only 3% of people reported receiving remittances in Bitcoin and only 8% in US dollars using the Chivo Wallet. This is in line with the El Salvadoran Central Bank’s data which stated that in 2022 only 1.6% of remittances were sent through a digital wallet.

Silver Linings

About 70% of the population of El Salvador is unbanked, meaning they don’t maintain a regular bank account or have access to typical banking services. Allowing everyone with a smartphone to access the Chivo Wallet opens up new avenues of access and services for a large swath of the population that has never had these options before.

Sometimes it could take an hour or more on a bus to visit a bank on their day off to cash their checks. Workers can now receive their paychecks daily or weekly without having to visit a bank. The Chivo Wallet has two accounts, one for Bitcoin and the other for US dollars. They can transact in Bitcoin or dollars and anyone else with the Chivo wallet app can receive Bitcoin or dollars.

For many El Salvadorans, this is the first time they have encountered the ability to have banking services like a savings account. Many report using the Bitcoin account as their savings account and their US dollar account as their checking account. Increasing access to banking services and financial inclusion is one major positive outcome of this policy shift.

Lessons Learned

National Bureau of Economic Research

The adoption of Bitcoin as legal tender in El Salvador hasn’t reached critical mass for a variety of cultural and administrative reasons. These results are despite one of the benefits lauded of the Chivo Wallet was enabling contactless payments during COVID-19. A major hiccup was that the government’s top down decision surprised and confused the population with little warning which only exacerbated issues with their roll out.

El Salvadorans are accustomed to an anonymous cash economy expressed in US dollars and many don’t trust the new technology, especially after a botched launch with many technical issues with the Chivo Wallet. Many people were enticed to participate only to claim the free money reward and then abandoned the program. The lack of privacy or trust in the system and the price volatility of Bitcoin are two other deterrents to participating.

In a country that is highly unbanked, the ability to include more people into the financial system and reduce friction for workers getting paid is a major benefit that should be acknowledged despite the clunkiness of the approach. The Bitcoin experiment in El Salvador is a financial exploration that we can all learn from. We’ll be watching closely.

Also read:

- [New] 2024 Approved Unveil 10 Filter Gems to Elevate Your TikTok Posts

- [Updated] Charting the Course for Your YouTube Music Narrative

- [Updated] Cutting-Edge Techniques A Guide to Next-Level Effectiveness in Your YouTube Ads

- [Updated] TikTok Glitches Troubleshooting iOS/Android Issues for 2024

- 15 Books That Have Conquered Social Media with BookTok Flair

- A Cycle of Adversity and Endurance: The Story of Black Survival Through Generations

- Factory Reset on Apple iPhone 13 mini | Dr.fone

- How to Reset Infinix Note 30i Without the Home Button | Dr.fone

- How To Transfer Data From Apple iPhone 11 Pro To Other iPhone 14 Pro Max devices? | Dr.fone

- Mastering Android: A Step-by-Step Guide to Using The Measuring App

- Premium Convert MP4 to Facebook Media for 2024

- Resolved: Unsupported Graphics in Premiere Pro with AMD/Intel

- Stellar Data Recovery for iPhone 7 Plus failed to recognize my iPhone. How to fix it? | Stellar

- The way to get back lost data from Honor Magic V2

- Use Device Manager to update hardware drivers on Windows 11/10/7

- Title: Navigating the New Era of Bitcoin Legality: Understanding El Salvador's Groundbreaking Move

- Author: Ian

- Created at : 2025-02-13 00:59:14

- Updated at : 2025-02-19 18:31:00

- Link: https://techidaily.com/navigating-the-new-era-of-bitcoin-legality-understanding-el-salvadors-groundbreaking-move/

- License: This work is licensed under CC BY-NC-SA 4.0.